Dear readers and investors, I hope you are safe and healthy.

May was another month of reducing my portfolio. As you may know, this doesn’t mean that I’m quitting P2P. I’m just lowering my risk until these kinds of companies become regulated and licensed.

You can take a better look of my results on the table below:

| Platform | Portfolio Value | Monthly Profit | Total Profit | XIRR |

| Mintos | €1855.82 | €22.57 | €213.42 | 11.66% |

| Swaper | €500.24 | €2.4 | €139.05 | 11.90% |

| PeerBerry | €1633.38 | €17.52 | €138.76 | 12.21% |

| Robocash | €509.21 | €14.48 | €111.70 | 11.44% |

| Iuvo Group | €398.40 | €3.86 | €12.33 | 12.92% |

| Crowdestor | €1321.61 | €0 | €21.61 | 2.94% |

| Lendermarket | €200 | €3.92 | €7.88 | 13.73% |

| Kuetzal | €0 | €0 | -€200 | N/A |

| Envestio | €0 | €0 | -€200 | N/A | Grupeer | €2699.01 | €0 | -€2699.01 | N/A |

| Total | €6 346.54 | €64.75 | -€2520.83 | 7.68% |

Mintos

During May, Mintos updated their lending company pages as well as the companies that left the platform.

Mintos posted announcements for investors from the lending companies and also updated the status of the defaulted lending companies and the recovery of invested funds.

Swaper

Swaper made 3 updated during May.

They have a new referral campaign, in which investors are able to earn based on the invested money of the friend in the first 30 days.

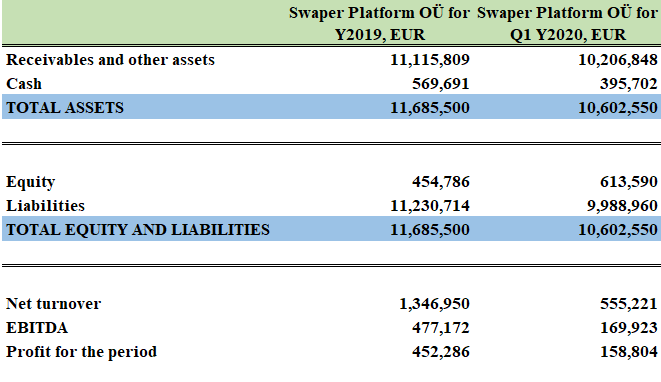

Swaper is also finishing its financial audit of the year 2019 and shared the results of the first quarter of the year 2020:

There’s an updated about page in their website that shows their team.

They also stated that there’s a growth in average funding by 35%, which is good news. Various options are being given to the borrowers to repay their loans (split repayment in parts, refinancing, payment deferrals, extending the loan repayment, etc.)

Overall, I’m happy with Swaper’s annoucements this month. I’m not so happy with my monthly income, but I guess it is normal with the amount of money I have currently invested in the platform.

PeerBerry

PeerBerry was kind enough to send a summary of their latest articles with useful information for investors:

On 28th May PeerBerry added new loan originator Senmo – Aventus Group company in Vietnam. More about the company: https://peerberry.com/blog/new-peerberry-offer-vietnamese-loans-with-125-roi/

Opportunity to invest in real estate loan (Lithome offer): https://peerberry.com/blog/lithome-offer-with-11-return-on-investment-real-estate-project/

Aventus Group CEO answered questions about how the close partnership between loan originators and PeerBerry helped to protect the interests of investors during the most difficult phase of the crisis: https://peerberry.com/blog/aventus-group-ceo-a-trofimovas-together-we-have-saved-business-confidence-of-investors-and-jobs/

Article about PeerBerry loan originator in Moldova: https://peerberry.com/blog/aventus-group-company-in-moldova-maintains-profitable-activity/

Article about PeerBerry loan originator Credit Plus UA: https://peerberry.com/blog/peerberry-loan-originator-credit-plus-ua-predicts-a-profitable-year-2020/

PeerBerry April review: https://peerberry.com/blog/2020-april-the-first-positive-signs-towards-stabilization/.

In May, PeerBerry started receiving Financial statements 2019 from their loan originators. The financial statements of these PeerBerry loan originators are currently available for review:

- https://peerberry.com/originators/credit-plus-ua/

- https://peerberry.com/originators/credit7-md/

- https://peerberry.com/originators/credit365-md/

- https://peerberry.com/originators/soscredit-cz/

- https://peerberry.com/originators/lithome/

In May, it is possible to see by analyzing the chart below that PeerBerry is recovering from the last tough months.

Robocash

Robocash shared some of their results compared with last years:

Within the first 4 months of 2020, Robocash Group issued 1.1 million loans for the amount of USD 95 million. Despite the fact that we have reduced disbursal volumes to ensure the stability of the group, we have kept the positive profit of USD 2.35 million and maintained the retained earnings at the level of USD 36.4 million.

To adapt to the challenging conditions, Robocash has reduced fixed costs by 27% and variable costs by 40%.

They’ve also tightened the scoring procedures in many of the countries in which they operate. These results in a reduce of borrowers, but an increase in borrowers that will actually pay their loans.

Robocash also shared those 3 different scenarios in which even in the worst case, they think they can reach USD 10.3 million in the net profit this year.

I am quite satisfied with my monthly income, since I reduced my portfolio considerably.

Crowdestor

Still no monthly income for Crowdestor, as most (if not all) projects interrupted their payments during the inital months of the pandemic.

Fortunately, some companies have already announced during this month to come back to payments. So, good news finally.

Iuvo Group

Iuvo Group started a campaign in which the invested funds (account balance funds do not count) bring privileges to investors.

They’ve also wrote an article about how they can afford to give their investors stability, regardless of the current situation. You can read more about this post here.

Overall, I’m content with Iuvo Group’s performance this month.

Lendermarket

Lendermarket has introduced a new functionality – an extension of maturity – in the response to the coronavirus pandemic.

What will be changed?

- Consumer finance companies will have the possibility to change the payment schedule of a loan by extending the maturity, according to the agreement with the customer.

- The change will only affect the maturity of the loan; it will not affect the number of installments or loan amounts.

- The consumer finance companies will fully compensate the investors. While extensions are active, investors will continue to accrue interest on investments, including late interest.

Lendermarket has also updated its rules of the platforms and agreements.

Interest in Creating Your Own Blog?

I use Siteground to host my WordPress website. It’s cheap, reliable and fast.

0 Comments