Hello there!

I hope you had a great month and are ready for an update on all the platforms I consider good to invest in the crowdlending space.

| Platform | Portfolio Value | Monthly Profit | Total Profit | XIRR |

| Mintos | €1579.05 | €13.83 | €309.52 | 12.31% |

| Swaper | €316.42 | €3.94 | €184.14 | 13.52% |

| PeerBerry | €1003 | €12.79 | €229.14 | 12.76% |

| Robocash | €543.99 | €3.67 | €146.48 | 11.94% |

| Iuvo Group | €414.92 | €2.68 | €28.66 | 9.95% |

| Crowdestor | €1342.73 | €9.17 | €115.34€ | 6.54% |

| Lendermarket | €136.51 | €1.14 | €15.51 | 13.83% |

| Kuetzal | €0 | €0 | -€200 | N/A |

| Envestio | €0 | €0 | -€200 | N/A | Grupeer | €2699.01 | €0 | -€2699.01 | N/A |

| Total | €5 336,62 | €47,22 | -€2069,12 | 8.1% |

Crowdestor

Crowdestor is one of the platforms that is receiving more critics from investors during these hard times. Even though it was expected there would be a pause in the SME loans, people (maybe including myself) started to be suspicious about many platforms due to the Grupeer, Envestio, and Kuetzal cases.

The CEO of Crowdestor thinks (maybe with reason) that people are possibly being a little bit too hard on them and he explains why in this post from explorep2p.

Besides this, the platform already returned the money from the Limp Bizkit concert (for whom voted to receive it) and also launched a new secondary market feature (nice!).

Iuvo Group

Iuvo Group has made a Q&A session where you can hear about the latest concerns of investors.

Lendermarket

Probably the biggest announcement from Lendermarket is that it’s loan originator – Credistar Group is going to get audited from KPMG on 2020. Good news which proves seiriousness from the company.

Mintos

Mintos is starting to agree with loan originators about default loans towards investors. It is good to know they have not given up on our money, even though the response could have been better.

I also like the fact they’re changing the so-known buyback guarantee to buyback obligation. It makes total sense and hopefully, it will be clearer for everyone (especially new investors unaware of the P2P world).

PeerBerry

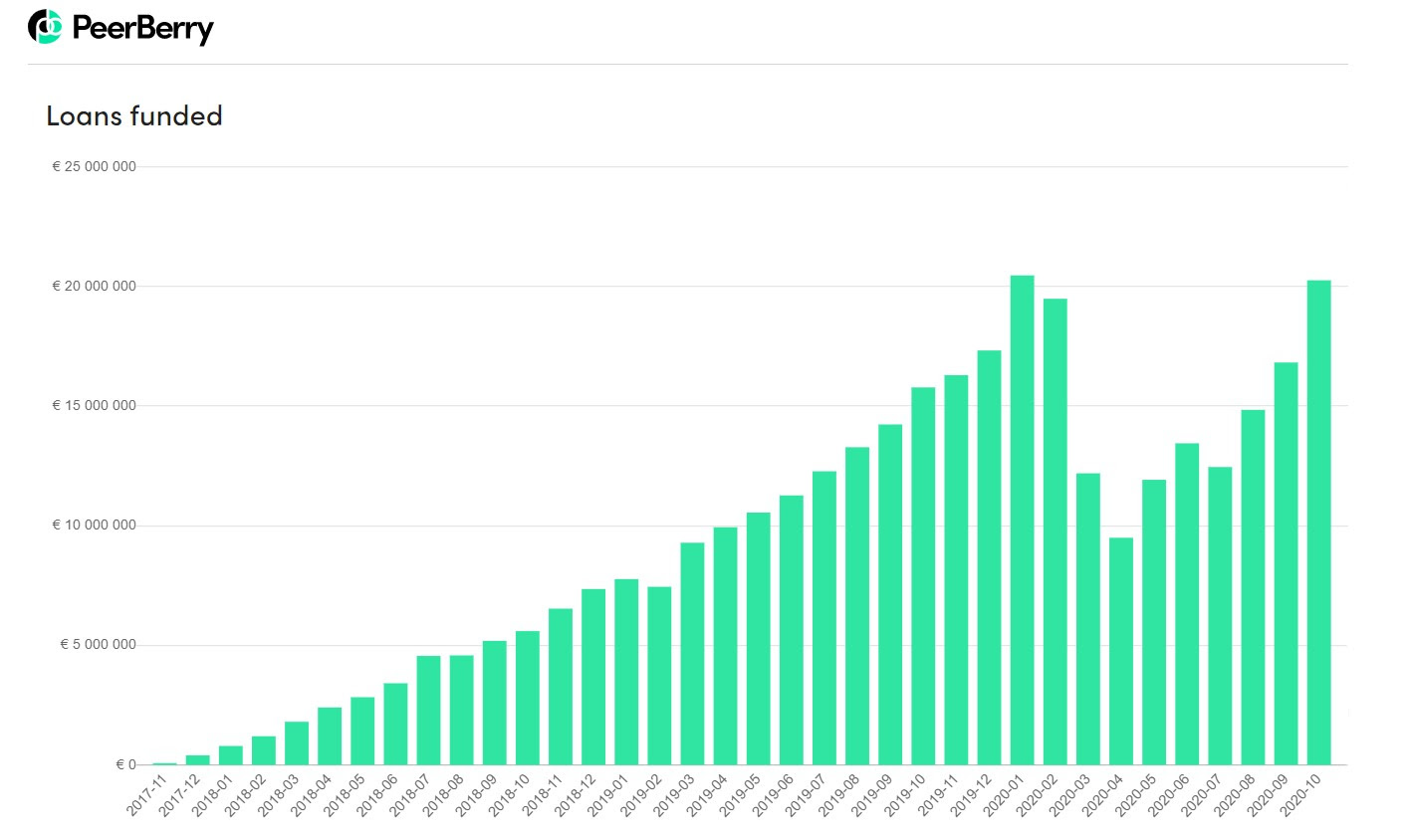

Great news from PeerBerry once again. Aventus Group will finish 2020 with a net profit of 10 million EUR.

Also, they’ve disclosed the results of this year and until now in the month of the 3rd PeerBerry birthday:

The main PeerBerry figures for the end of September 2020

- the total loan volume originated since inception – 343 284 974 Eur (+6.3% growth)

- the loan volume originated in October – 20 258 473 Eur (+20.5% vs September)

- the number of loans originated in October – 147 407 (+25.7% growth vs September)

- the interest earned by investors since inception – 3 738 097 Eur (+5.6% growth)

- the average annual ROI at the end of October – 12.01% (+1.03 pp vs September)

- the average nominal interest rate of loans originated in September – 11.32 % (+1.15 pp vs September)

- the number of investors at the end of October – 27 432 (+1085 new investors per month)

Robocash

Robocash is managing to increase its earning in a tough year like 2020, I’ll surely keep investing with them.

Swaper

Not much happened during this month in Swaper. The returns were stable and I’m still happy with the platform and the company.

Interest in Creating Your Own Blog?

I use Siteground to host my WordPress website. It’s cheap, reliable, and fast.

0 Comments